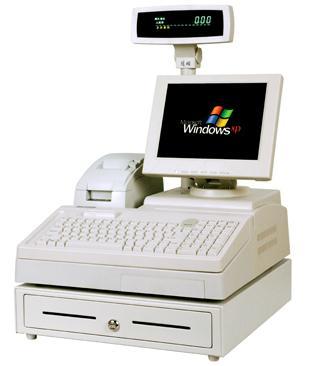

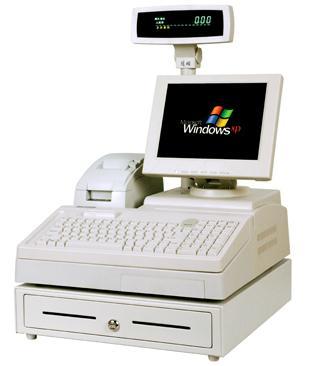

In past articles, I've established the foundation of know-how that makes it possible for merchants to know that it can be imperative they accept credit cards as a way to maintain their enterprise competitive. As a way to commence accepting credit cards, you must opt for a merchant solutions provider to establish and preserve your processing account. When you have chosen a merchant solutions provider, you'll have to give them together with your decision of a Point of Sale (POS) terminal. They are going to most likely supply you suggestions on which terminal would be very best suited to your organization, but it doesn't hurt to be well-informed just before creating your choice. In today's planet, it seems like all the things is being switched more than to wireless: wireless lights, wireless chargers, wireless phones, wireless gaming stations and, for the purposes of this article, wireless POS credit card processing terminals. The question is: does your enterprise have to have wireless processing capabilities? You will find some issues to think about before deciding on a wireless processing resolution.

To know more about mobile money

1st of all, as you could have guessed, wireless terminals cost extra than their wired counterparts. On average, employing a wireless terminal will price your business an extra $20 per month. This cost covers your terminal connecting to a cellular payment processing service provider. Think of it like your cellular phone bill; it can be the cost you spend to connect to their towers. Also pertaining to cost, you could desire to take into account that most merchant service providers will cost their wireless terminal lease agreement at a higher price than non-wireless terminals. They are far more complex machines that require far more all round technical help and setup time than standard terminals. For example, you could have the ability to use a wired terminal, leased at $29.99/month, but its wireless cousin would price you $39.99/month plus $20/month to get a wireless plan. You need to weigh the added cost of wireless comfort against no matter whether it will give you a return on your investment.

When choosing a wireless terminal, consider what network your processing will probably be going by means of. Your merchant solutions provider can answer this question for you personally. Consider about all the occasions you have asked, "Can you hear me now?" Properly, this translates similarly when discussing wireless terminal processing. If your wireless service provider doesn't have good coverage at your company, your transaction process could grow to be unnecessarily complicated. It may well finish up that your terminal option comes down to what providers perform with every terminal after which picking a single according to excellent coverage. Once again, this can be a thing to talk about along with your MSP when deciding on a wireless terminal.

Certain enterprises possess a track record of benefiting from wireless POS terminal convenience, which includes restaurants, substantial retail shops and seasonal shops. A massive advantage is often observed in the restaurant industry since wireless terminals let table spend capabilities. This means that a server can carry a wireless terminal with them and accept buyer payments instantly, permitting the payment card to under no circumstances leave the customer's internet site and freeing up congestion close to otherwise crowded countertop terminals. For restaurants, this increase in processing speed could net large returns. As an instance, believe about a restaurant with 20 tables and an average receipt of $45. By growing table turnover by one particular celebration per table, on a busy night, this restaurant could earn an additional $900. As you could see, shaving some additional minutes off payment processing time really adds up!

Any store exactly where connecting to a wired terminal is either not attainable or not practical would needless to say ought to examine the wireless selection. Most importantly, any contractor or consultant that doesn't perform at a fixed place would ought to appear into employing a wireless POS. For example, I recently had a plumber come by my home to repair a leaky toilet. He did an incredible job and was a friendly guy, nevertheless it was a massive inconvenience to me when it came time for you to spend. This certain contractor did not accept credit cards and I did not have cash on me. I ended up having to run towards the ATM in town to pull out $150 in money, with this plumber waiting at my home, so as to pay him. Depending on this inconvenience, would I get in touch with this plumber again? Potentially. I knowledgeable no "real" problems with his function, but paying him was such a discomfort that I may well call some other contractors initial. Case in point: had he had a wireless terminal and processing capabilities, I would happen to be a a lot more satisfied consumer.

Click here SMS Printer

Aside from these special circumstances, your company can most likely get away with (and could be superior off with) a wired POS solution. Wired solutions have no reception difficulties, price much less per month and supply you a wider variety of terminal choices. But, should your company fall into certainly one of the aforementioned categories, you'll want to weigh the benefits and drawbacks of a wireless terminal and hopefully see an increase in your bottom line.

To know more about mobile money

1st of all, as you could have guessed, wireless terminals cost extra than their wired counterparts. On average, employing a wireless terminal will price your business an extra $20 per month. This cost covers your terminal connecting to a cellular payment processing service provider. Think of it like your cellular phone bill; it can be the cost you spend to connect to their towers. Also pertaining to cost, you could desire to take into account that most merchant service providers will cost their wireless terminal lease agreement at a higher price than non-wireless terminals. They are far more complex machines that require far more all round technical help and setup time than standard terminals. For example, you could have the ability to use a wired terminal, leased at $29.99/month, but its wireless cousin would price you $39.99/month plus $20/month to get a wireless plan. You need to weigh the added cost of wireless comfort against no matter whether it will give you a return on your investment.

When choosing a wireless terminal, consider what network your processing will probably be going by means of. Your merchant solutions provider can answer this question for you personally. Consider about all the occasions you have asked, "Can you hear me now?" Properly, this translates similarly when discussing wireless terminal processing. If your wireless service provider doesn't have good coverage at your company, your transaction process could grow to be unnecessarily complicated. It may well finish up that your terminal option comes down to what providers perform with every terminal after which picking a single according to excellent coverage. Once again, this can be a thing to talk about along with your MSP when deciding on a wireless terminal.

Certain enterprises possess a track record of benefiting from wireless POS terminal convenience, which includes restaurants, substantial retail shops and seasonal shops. A massive advantage is often observed in the restaurant industry since wireless terminals let table spend capabilities. This means that a server can carry a wireless terminal with them and accept buyer payments instantly, permitting the payment card to under no circumstances leave the customer's internet site and freeing up congestion close to otherwise crowded countertop terminals. For restaurants, this increase in processing speed could net large returns. As an instance, believe about a restaurant with 20 tables and an average receipt of $45. By growing table turnover by one particular celebration per table, on a busy night, this restaurant could earn an additional $900. As you could see, shaving some additional minutes off payment processing time really adds up!

Any store exactly where connecting to a wired terminal is either not attainable or not practical would needless to say ought to examine the wireless selection. Most importantly, any contractor or consultant that doesn't perform at a fixed place would ought to appear into employing a wireless POS. For example, I recently had a plumber come by my home to repair a leaky toilet. He did an incredible job and was a friendly guy, nevertheless it was a massive inconvenience to me when it came time for you to spend. This certain contractor did not accept credit cards and I did not have cash on me. I ended up having to run towards the ATM in town to pull out $150 in money, with this plumber waiting at my home, so as to pay him. Depending on this inconvenience, would I get in touch with this plumber again? Potentially. I knowledgeable no "real" problems with his function, but paying him was such a discomfort that I may well call some other contractors initial. Case in point: had he had a wireless terminal and processing capabilities, I would happen to be a a lot more satisfied consumer.

Click here SMS Printer

Aside from these special circumstances, your company can most likely get away with (and could be superior off with) a wired POS solution. Wired solutions have no reception difficulties, price much less per month and supply you a wider variety of terminal choices. But, should your company fall into certainly one of the aforementioned categories, you'll want to weigh the benefits and drawbacks of a wireless terminal and hopefully see an increase in your bottom line.

No comments:

Post a Comment